Navigating through the complex world of finance can be daunting, especially when it comes to personal budgeting and expenditure tracking. But in the era of digital innovation, various financial planning apps have come to the rescue, helping Malaysians make informed decisions about their money. In this comprehensive guide, we explore the ‘Top 10 Financial Planning Apps in Malaysia 2026’, highlighting their unique features, intuitive interfaces, and innovative strategies designed to empower users to take control of their finances.

The growing popularity of these applications has dramatically transformed the way we manage our personal finances, allowing for seamless budgeting, efficient expense tracking, and strategic financial planning, all at our fingertips. From helping users pay off debt, save for their future, to offering insights into spending patterns, these apps deliver an all-encompassing financial management solution. Here are the top 10 best financial planning apps in Malaysia.

Can Financial Planning Apps Help Me Save For Specific Goals?

Absolutely! Financial planning apps often include goal-tracking features that enable users to set savings targets for specific objectives, such as buying a house, starting a business, or saving for retirement. The apps provide progress tracking and suggestions to help achieve those goals.

Are Financial Planning Apps Secure?

Most reputable financial apps employ high-level security measures to protect user data which includes encryption, two-factor authentication, and secure sockets layer (SSL) technology. However, users must also do their part by setting strong while unique passwords and keeping their devices secure. Always remember to download apps from official app stores to avoid counterfeit apps that may pose security risks. It’s also a good idea to regularly check app permissions and ensure that they’re only granted the access necessary to function correctly.

10 Best Financial Planning Apps in Malaysia 2026

1. Money Manager

Money Manager is a highly optimized personal account management application. Simplifying the complex facets of household account management, the app provides super easy data entry, graphical spending tendencies, and statistical overviews. Its default settings offer a smooth start, with flexible and customizable features to cater to individual needs. Data can be edited, sorted, and viewed graphically on your PC via Wi-Fi.

Pros:

- Manage your savings, insurance, loans and real-estate

- Set a monthly budget for each category

- Review asset trend in your chart

Price: Free

*Prices may vary at the time of purchase

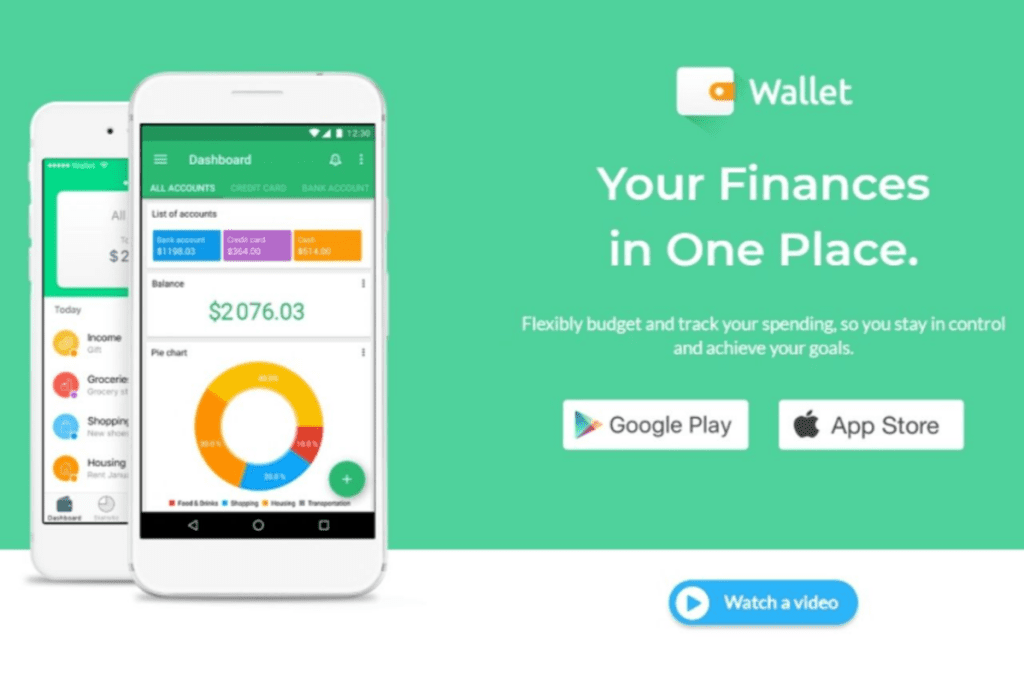

download for andriod download for ios2. Wallet: Budget Planner Tracker

Wallet is a top personal finance manager designed to help you save money, plan for the future, and consolidate all your finances in one place. Automatic daily spending tracking, insightful weekly reports, shopping planning, and data sharing are all at your fingertips to provide a comprehensive view of your money anytime and anywhere.

Pros:

- BudgetBakers does not sell customer data to 3rd parties.

- Automated upcoming payment notifications.

- best-in-breed AI driven categorization and analytics

Price: Free

*Prices may vary at the time of purchase

download for andriod download for ios3. AndroMoney

AndroMoney is a mobile personal finance tool aimed at better wealth management. It always prioritizing ease of use and power while handles daily accounting, category management, and detailed report generation effortlessly. Its features include multiple accounts and currencies, account balance and transfers, and cloud storage support.

Pros:

- Get the statistic report(pie chart, bar chart, curve chart….)

- Can add, delete or modify the category according to your need.

- Can use different currencies while shopping abroad.

Price: Free

*Prices may vary at the time of purchase

download for andriod download for ios4. Money Lover

Money Lover offers a quick and easy way to record daily transactions and categorize them into clear, visual categories such as food, shopping, salary, or gifts. With an easy-to-read report, understanding your spending patterns and tracking where your money goes becomes simple and efficient.

Pros:

- Painless budgeting

- One report to give a clear view on your spending patterns

- Safely synchronize across devices with Bank standard security

Price: Free

*Prices may vary at the time of purchase

download for andriod download for ios5. Monefy

Monefy aims to give you control over your money with a user-friendly personal finance application. Monefy facilitates effective money management by breaking down your expenses in an intuitive and understandable way. Identify spending patterns and start saving money more effectively with this handy tool.

Pros:

- Add records in a flash

- You’re in full control

- No time-consuming setup process

Price: Free

*Prices may vary at the time of purchase

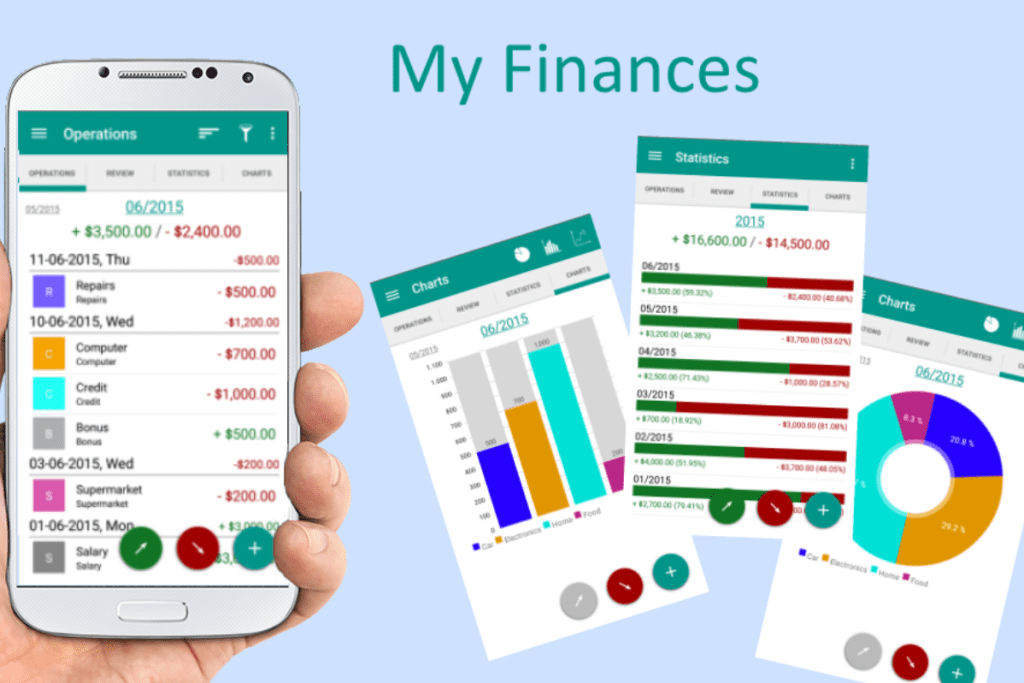

6. My Finances

My Finances serves as an ideal tool for managing home budgets and controlling expenses. Thanks to its well-selected functions, not only can you save more money, but also gain a more precise analysis of your expenditures. Its attractive and intuitive interface aids in effortlessly adding new transactions and examining the existing ones that allows for a clearer understanding of your financial status and smarter budgeting decisions.

Pros:

- Safe data in cloud

- Multi device access

- Can generate reports

Price: Free

*Prices may vary at the time of purchase

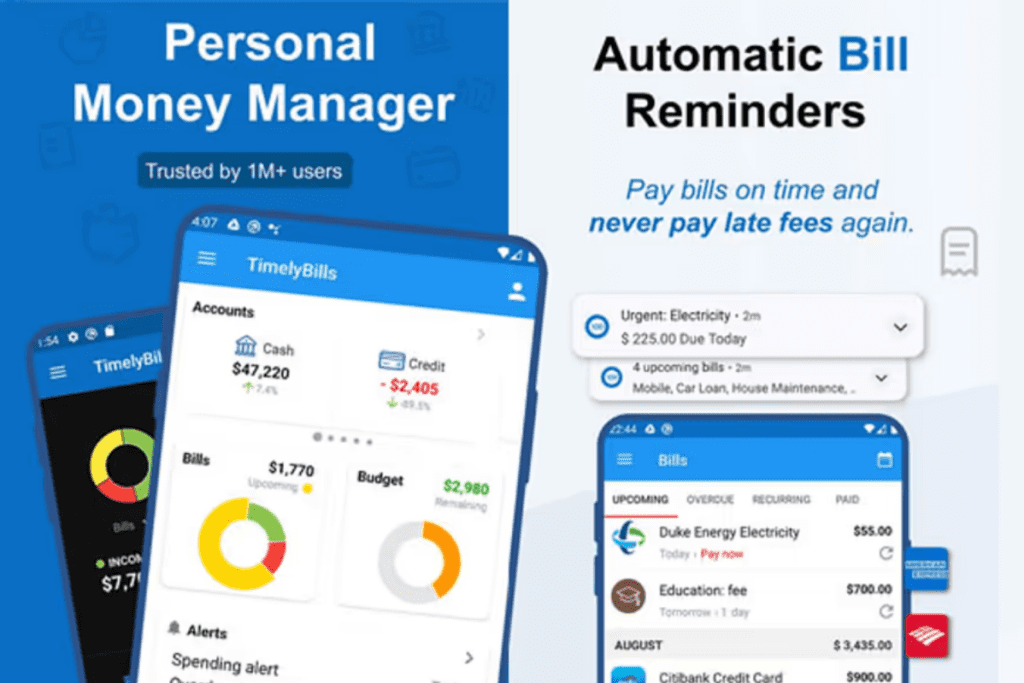

7. Bills Reminder, Budget Planner

Bills Reminder, Budget Planner is a reliable expense tracker, budget planner, and a bills reminder all in one. It ensures that you never miss a payment for helping to maintain your credit score and secure the best interest rates on loans and affordable insurance plans. With smart spending alerts to prevent overspending, it acts like your personal finance manager to ensure you stay within your budget.

Pros:

- Create your custom categories to track all your expenses

- Download PDF & Excel reports

- Retirement funds calculator

Price: Free

*Prices may vary at the time of purchase

Download for Andriod download for IOS8. Goodbudget

Goodbudget modernizes the time-tested envelope budgeting method with a virtual budget program. This budget tracker ensures you are always prepared for bills and sudden expenses that enable you to effectively manage your finances. Furthermore, it helps you tackle debt, tracking your payoff progress and projecting a debt-free timeline while still considering your other financial necessities.

Pros:

- Sync & share budgets

- Pay off debt

- Make envelopes for all your budgeting categories

Price: Free

*Prices may vary at the time of purchase

Download for Andriod download for IOS9. YNAB

YNAB offers a unique perspective on managing finances. This budgeting app empowers you to dictate where your money goes and encourages intentional spending on things that truly matter. With its simple method, YNAB has helped millions transform their relationship with money, enabling users to take control of their finances and work towards a future they’ll love living.

Pros:

- Flexible method for managing your finances

- Can share your budget with loved ones

- The Average User Saves $600 in 2 Months

Price: Free

*Prices may vary at the time of purchase

Download for Andriod download for IOS10. Usepod

Pod Budgeting App is a user-friendly financial management tool designed to simplify budgeting and expense tracking. Tailored for individuals and families, the app offers intuitive features that help users plan, monitor, and control their finances effectively. With Pod, users can set budgets, track spending, and categorize expenses to gain clear insights into their financial habits. The app provides real-time updates and visual reports, making it easy to adjust spending and achieve financial goals. Pod Budgeting App prioritizes ease of use and security, ensuring that managing your finances is both straightforward and safe.

Address: Kuala Lumpur, Malaysia

Phone No: 011-6245 9186

Google Reviews: Here

Facebook: https://www.facebook.com/usepodapp/

Instagram: https://www.instagram.com/usepodapp_my/

VIEW WEBSITEDisclosure: This list was compiled by the team at My Weekend Plan after extensive research and shared opinions to suggest helpful recommendations for the public. The sequence of brands is in no particular order so if you have any other great suggestions too, please email us support@myweekendplan.asia. For more information, kindly refer to our copyright, privacy & disclosure policy.