In the hustle and bustle of modern life, where time is a precious commodity and financial decisions often take a backseat, finding a reliable avenue to grow your savings becomes paramount. In Malaysia, a country known for its diverse cultural tapestry and vibrant lifestyle, the quest for the best-fixed deposit rates becomes a financial endeavour and a lifestyle choice—a savvy way to maximise returns while embracing the art of smart saving.

It is not just about financial prudence; it’s about embodying a lifestyle that values the present and the future. This guide is your key to unlocking the best-fixed deposit rates in Malaysia, allowing you to relish the perks of astute financial planning without compromising the essence of your unique lifestyle.

Let’s explore Malaysia’s money world, figuring out the best-fixed deposit deals that make sense for your wallet and match the lively spirit of Malaysia.

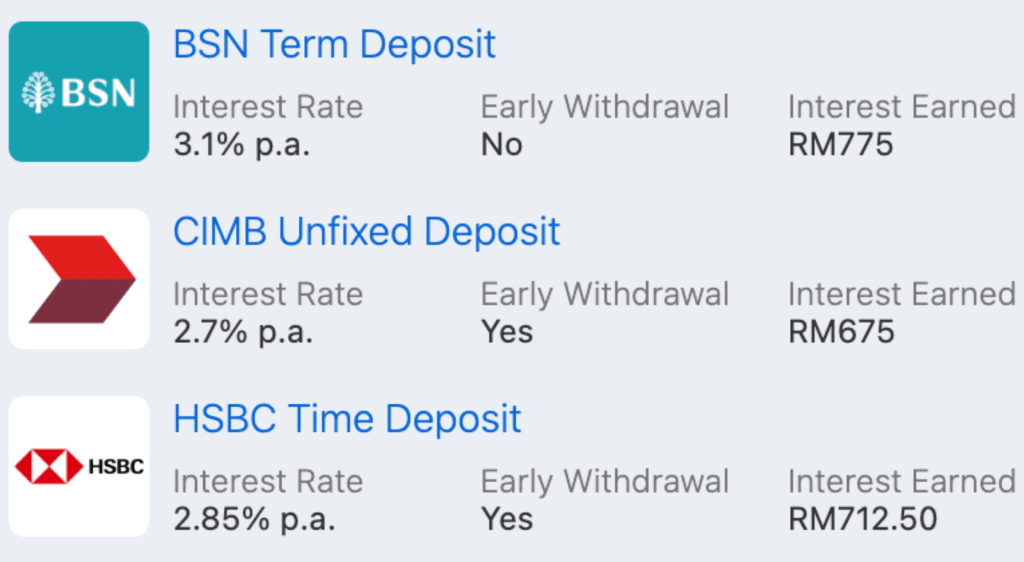

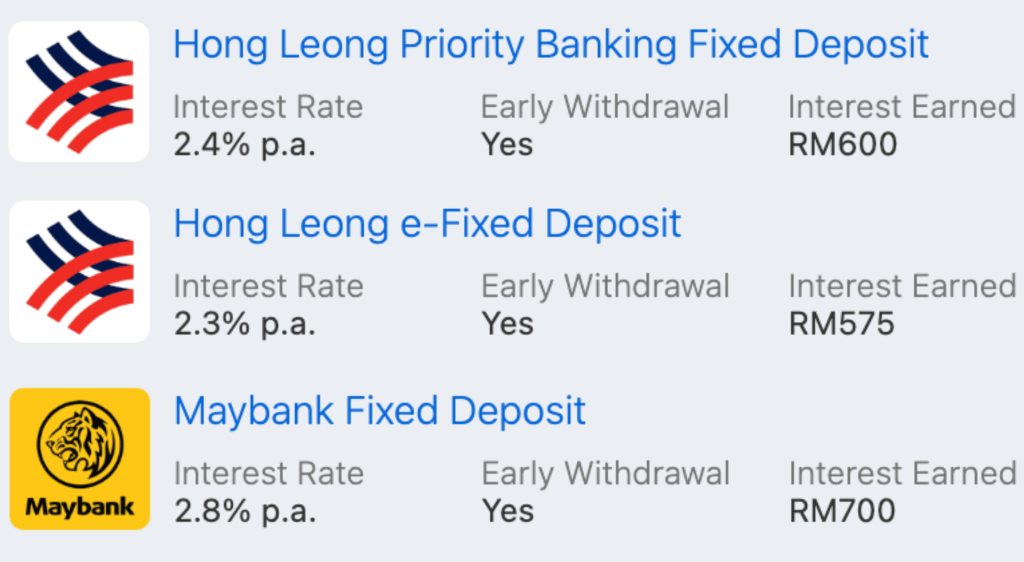

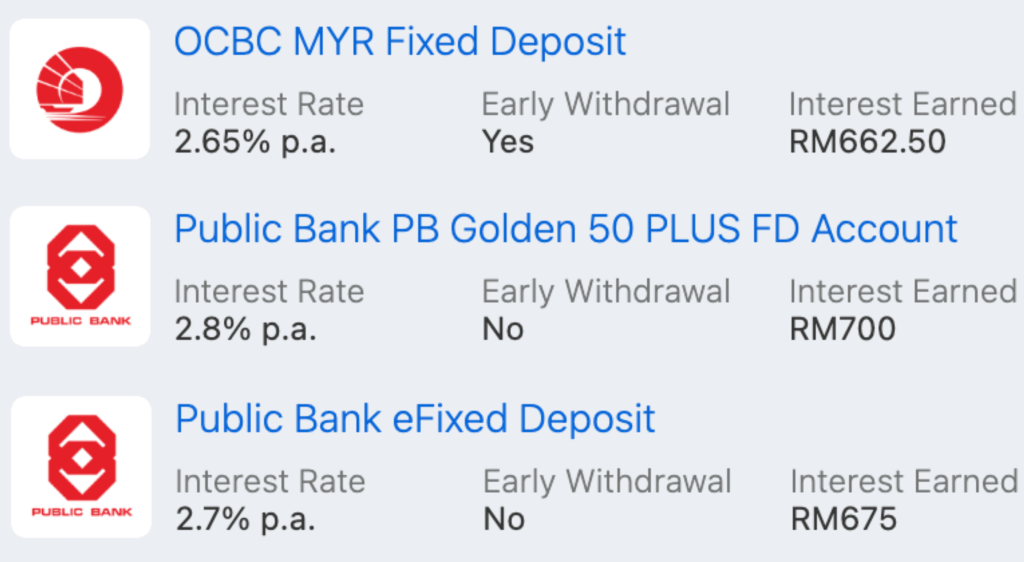

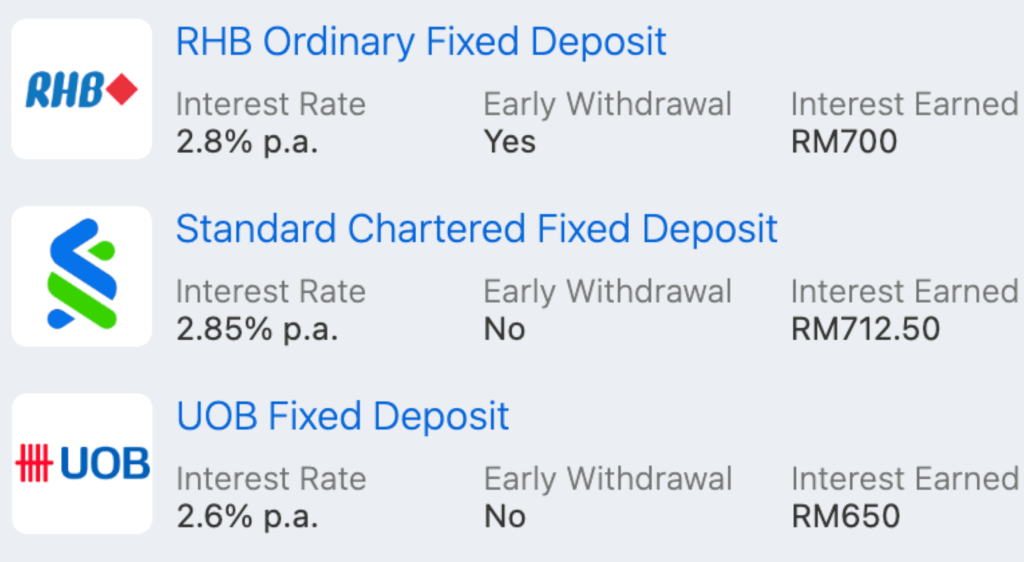

1. Banks with The Best Fixed Deposit Rates in Malaysia

According to RinggitPlus, here is a list of popular banks, their interest rates, early withdrawal approval processes, and the corresponding interest you will earn. This list will help make it easier for you to narrow your options.

2. What are Fixed Deposits?

A Fixed Deposit (FD), widely regarded as a secure investment option, stands out as a preferred choice for novice investors. FDs offer a guaranteed high return, ease of management, loyalty rewards, and government insurance protection, which provide a reliable sanctuary.

Unlike conventional savings accounts with daily interest and unrestricted withdrawals, FDs limit access to invested funds. Early withdrawals, even by a single sen, result in the forfeiture of any interest accrued, emphasizing the commitment required until the maturity date for optimal returns.

3. Is There a Guaranteed Return on Investment?

Simply gather your spare cash, open an FD account, and claim your interest upon maturity. For instance, consider applying for a 6-month FD with a minimum deposit of RM5,000 at an annual interest rate of 3.65%.

By placing your cash in the FD account, you will receive your initial deposit (principal) along with an interest of 3.65% per annum, resulting in an Effective Interest Rate (EIR) of 1.82% after 6 months. While interest is calculated daily, it is paid out only at maturity, making it a hassle-free and passive investment.

The following illustrates the potential earnings from a short-term fixed deposit with a higher deposit amount:

| 6-MONTH FIXED DEPOSIT | INTEREST RATE AT 3.65% P.A. |

|---|---|

| Deposit Amount (RM) | 6-month Interest Profit (RM) |

| 5,000 | 90.43 |

| 20,000 | 361.73 |

| 50,000 | 904.32 |

If you choose a placement period longer than 1 year, you will have the flexibility to receive your interest earnings either annually or monthly, with the maximum placement period in Malaysia being 5 years.

Let’s calculate the total interest earnings for an FD with a principal investment of RM50,000 at a 3.65% p.a. interest rate for 6 months:

- (Yearly Interest Rate/12 Months) x Placement Period In months = Effective Interest Rate (EIR)

(0.0365/12) x 6 = 1.82% - Principal Investment x EIR = Total Interest Earnings

RM50,000 × 1.82% = RM910

4. What Types of Fixed Deposits Are Available in Malaysia?

Banks typically employ two main methods to seemingly ‘boost’ the interest rates of their products during promotions: scaling the interest rates, commonly referred to as Step-Up, or combining the fixed deposit with a current or savings account, known as CASA Bundling. Some promotions may even incorporate both Step-Up and CASA Bundling strategies.

- Step-Up Fixed Deposit

Here, your fixed deposit (FD) placement period is divided into steps, where each step corresponds to a different month with a varying interest rate—each step incrementally higher as you ascend. In this scenario, the prominently advertised rate is typically applicable only for the final month or ‘step’ of the FD period. It’s important to note that the Effective Interest Rate (EIR) will always be lower than the advertised rate.

For instance, Bank Y’s promotion claims an interest rate of up to 6.88% per annum for a 6-month Fixed Deposit.

| MONTH 1 – 2 | MONTH 3 – 4 | MONTH 5 | MONTH 6 | TOTAL | |

|---|---|---|---|---|---|

| Interest rate (p.a.) | 3.00% | 3.15% | 3.24% | 6.88% | 3.73% |

| Interest earned on RM10,000 (RM) | 49.39 | 52.08 | 26.88 | 56.31 | 184.66 |

However, upon closer inspection, the table indicates that the 6.88% interest p.a. applies solely during the tenure’s 6th and concluding month. Upon calculating the Effective Interest Rate (EIR), the actual interest rate is revealed to be only 3.73% per annum, resulting in a profit of RM184.66 when considering the entire 6-month period.

2. Fixed Deposit with CASA Bundling

When considering a fixed deposit (FD) bundled with a current or savings account (CASA), you might be enticed by a potentially higher interest rate. To unlock these benefits, you must open a current or savings account with a minimum deposit.

Typically, the amount you must deposit into a current or savings account is either a fixed amount or a percentage of the total invested in the FD. While the bundled FD rate may appear appealing, it is crucial to remember that the cash in the CASA accrues interest at a lower rate.

| 6-MONTH PROMO FD | 6-MONTH CASA | TOTAL | |

|---|---|---|---|

| Initial Deposit | 10,000 | 5,000 | 15,000 |

| Interest rate (p.a.) | 4.28% | 0.5% | 3.01% |

| Interest earned (RM) | 211.76 | 2.50 | 214.25 |

The higher the amount you need to deposit into your CASA, the lower your Effective Interest Rate (EIR) will be.

5. What are the Differences Between Savings and Fixed Deposit Accounts?

While a savings account provides immediate access to funds, a Fixed Deposit (FD) account does not and typically offers a less lucrative interest rate. An FD entails investing a substantial amount, often beginning at RM1,000, for a predetermined duration. You receive a favourable interest rate by committing to keeping the money with the bank for this fixed period and refraining from early withdrawals.

The array of available savings and fixed deposit accounts complement each other—FDs allow for higher interest accumulation. In contrast, savings accounts offer readily available funds for everyday expenses and short-term emergencies.

RinggitPlus has succinctly outlined the key distinctions between fixed deposits and savings accounts below:

| ASPECTS | FIXED DEPOSIT | SAVINGS ACCOUNT |

|---|---|---|

| Reasons To Apply | To earn high interest on large sums of cash | Used for income savings and cashless spending |

| Interest Rate | Higher interest rate | Lower interest rate |

| Placement Period | Fixed period. Principal and interest are paid out at maturity | Continuous nature. Free to close account anytime |

| Minimum Deposit | A higher deposit of at least RM1,000 or RM5,000 | Deposits can be as low as RM20 |

| Frequency Of Deposits | The amount needs to be deposited only once. However, it can be renewed with fresh funds | Can be done any number of times. No restrictions |

| Cash Withdrawals | Not encouraged. Will terminate the account and lose out on interest earnings | Can be done anytime, but subject to a withdrawal limit |

6. Is it Possible to Make Full or Partial Cash Withdrawals?

For savvy savers, it is wise to initiate a fixed deposit only when you can commit to setting aside cash for the entire investment duration. Banks provide flexible tenures, ranging from as short as one month to as long as five years.

Opting for partial or full cash withdrawal, depending on your chosen investment duration, may result in the loss of some or all of your accrued interest earnings.

1. Placement of 1, 2 or 3 Months

Withdrawals made before the maturity of fixed deposit accounts with tenures of 1 to 3 months could lead to a complete loss of the interest earned on your deposited funds. Even if you opt for a small withdrawal the day before maturity, you will not receive any interest earnings.

2. Placement of more than 3 Months

For fixed deposits extending beyond three months, there are circumstances where you risk forfeiting your interest. In many instances, if you choose an early full or partial withdrawal within the initial three months, you lose all the generated interest.

If withdrawals are made after the initial three months, you will still earn interest, but it will be at half of the originally offered interest rate. Essentially, 50% of the interest earned becomes a fee for early withdrawal, and you will only be eligible to earn at a pro-rated rate for the remaining period, represented by the Effective Interest Rate (EIR).

7. Is Having Islamic Deposit Accounts Considered Prohibited (Haram)?

Mudharabah General Investment Account (GIA) is the Islamic equivalent of a conventional fixed deposit. Its key distinction lies in profit processing, adhering to the Syariah principle of Mudharabah. This principle involves a cost-plus-profit model where the bank sets predetermined profit margins to avoid interest or ‘riba,’ ensuring compliance with Halal practices.

Islamic banking in Malaysia falls under the coverage of Perbadanan Insuran Deposits Malaysia. However, this insurance coverage will be limited as a new deposit account framework comes into effect, coinciding with the phased-out transition of Mudharabah GIA under the Islamic Financial Services Act 2013.

8. What is the Islamic Financial Services Act 2013 (IFSA)?

Regulated by Bank Negara Malaysia, the Islamic Financial Services Act 2013 (IFSA) establishes a framework for Islamic banks, ensuring financial stability and Syariah law compliance. IFSA introduces two product classifications, such as principal guaranteed or investment accounts, effective by June 2015.

While some Islamic banks no longer insure Guaranteed Investment Accounts (GIAs), consider principal-guaranteed Islamic term deposits. Based on Commodity Murabahah, these deposits use commodities like palm oil and copper as assets. Your Islamic bank acts as an agent to buy and sell commodities, ensuring a guaranteed and PIDM-insured deposit aligned with Halal principles.

9. How to Open a Fixed Deposit?

Most banks cater to Malaysian residents and non-residents aged 18 and above for FD account setup.

To expedite your application, gather the necessary documents beforehand:

- Ensure a minimum initial deposit, typically RM1,000 for 1 month or RM5,000 for 2 months and above (can be in cash, cheque, or direct transfer to the FD bank account).

- Have your MyKad for identification.

Your spouse or family member should provide a copy of their MyKad for joint accounts.

Once you have opened the account, safeguard your Fixed Deposit Certificate, which outlines crucial details like your principal deposit, placement period, interest rate, and maturity date. Losing it requires prompt notification to the bank.

While a replacement certificate incurs fees (RM10 for stamp duty and up to RM15 for service), some banks like CIMB Bank now offer online FD placements without physical certificates. This convenient option eliminates worries about keeping track of a physical certificate, with additional features like online renewals or top-ups available in certain banks’ online banking applications.

Grab Your Complimentary Lazada Voucher 【Here】

Tons of Shopee Cashback Deals 【Here】

Disclosure: This list was compiled by the team at My Weekend Plan after extensive research and shared opinions to suggest helpful recommendations for the public. The sequence of brands is in no particular order so if you have any other great suggestions too, please email us support@myweekendplan.asia. For more information, kindly refer to our copyright, privacy & disclosure policy.