If you are a driver looking for a budget-friendly approach and comprehensive coverage, this guide is tailored just for you. Whether you are a new car owner or aiming to optimise your insurance plan, we provide essential insights. In a world where road uncertainties are common, having the right car insurance is not just a legal necessity but a wise financial choice.

Having cheap car insurance with good coverage provides financial security by minimising out-of-pocket expenses in the event of an accident, theft, or damage to your vehicle. It ensures you can repair or replace your car without a substantial financial burden, promoting peace of mind. Good coverage also may extend to liability protection, safeguarding your assets and offering legal support in case of third-party claims or lawsuits.

Read more to make the right choice for your safety and your car’s security:

1. What are the Cheap Car Insurances with Good Coverage?

The availability of cheap car insurance with good coverage can vary based on location, driving history, and the type of coverage needed. Here are some car insurance providers in Malaysia that offer good coverage:

1. Tune Protect

Tune Protect is committed to providing affordable motor insurance solutions in Malaysia, emphasising the financial well-being of vehicle owners. Its comprehensive coverage extends beyond accidents and theft to include liability protection for drivers not covered by the policy. Secure additional protection for your car against floods, landslides, typhoons, storms, earthquakes, and more. Obtain this coverage at an exceptionally affordable rate of 0.2% of the sum insured.

2. Maybank

Maybank’s Comprehensive Motor Insurance Takaful is a Shariah-compliant protection plan for your car and wallet, activated in case of any driving mishaps. Maybank offers a range of car insurance options to ensure the safety and security of diverse vehicles. The insurance covers third-party liabilities for bodily harm or death, damage to other’s property, accidental or fire damage to your vehicle or theft. Maybank’s vehicle insurance often includes additional features such as NCD (No Claim Discount) protection, allowing policyholders to enjoy reduced premiums even after making a claim.

3. Etiqa Takaful

Etiqa Takaful‘s car insurance delivers extensive coverage for various vehicle types. Grounded in the principles of mutual cooperation and shared responsibility, Etiqa Takaful operates on the concept of policyholders contributing to a collective fund to support one another in times of necessity. Offering two Sharia-compliant car protection plans, namely Car Takaful and Comprehensive Car Insurance, both options encompass coverage for risks such as theft, loss, fire, and vehicle damage.

Check out more car insurance available in Malaysia:

2. What is it Important to Get a Car Insurance?

Per the Road Transport Act of 1987, every car owner in Malaysia must possess valid car insurance and road tax, both of which must be renewed annually. Hence, driving on any public road in Malaysia without valid motor insurance and road tax is against the law.

Aside from that, there are various reasons why every vehicle owner should have car insurance, such as:

- Financial Protection

It provides financial security by covering repair costs, medical expenses, and third-party accident damages. This protection minimises the financial burden on the car owner in unforeseen circumstances. - Third-Party Liability Coverage

It includes coverage for third-party liabilities, protecting the policyholder from legal and financial responsibilities if their vehicle causes injury or damage to another person or property. This coverage is crucial for safeguarding against potential lawsuits and financial repercussions. - Peace of Mind

Car insurance also offers peace of mind, ensuring car owners are financially protected in case of accidents, theft, or other unforeseen events. It allows for worry-free driving and adds a layer of security to daily commuting.

3. What Types of Car Insurance Can You Find in Malaysia?

Understanding the significance of having car insurance, the Malaysian market offers three types of motor insurance, each designed to provide coverage for you and/or your vehicle with specific purposes.

| Insurance Type | Coverage | Additional Information |

|---|---|---|

| Third-Party Cover | Basic and economical coverage | – Protects against claims made by others in an accident. – Covers bodily injuries and damages to the other party. – Policyholders are responsible for their own vehicle’s damages and losses. |

| Third-Party, Fire and Theft Cover | Adds coverage for own vehicle against fire and theft | – Similar to third-party coverage but includes protection for own vehicle. – Covers damages from accidental fire or theft. – Excludes coverage for damages due to road accidents. – Claims applicable for fire damage, theft, or break-ins. |

| Comprehensive Cover | Broader range of coverage for own and third-party vehicles | – Includes benefits of third-party, fire, and theft coverage. – Additional protection against losses and damages to own vehicle. – Recommended for those unable to bear their vehicle repair costs. – Some insurers offer extra benefits to comprehensive policyholders. – Certain vehicles below a certain age may not qualify for this policy. – Ideal for owners of relatively expensive cars. |

4. What is Typically Not Covered by Car Insurance?

Take note of what is included and excluded from your coverage, as not all incidents are covered, even with a comprehensive car insurance plan that may be considered higher or the highest tier compared to other plans.

Here is a breakdown of conditions that may not be covered under your car insurance policy:

- Personal Injury or Death

- Standard car insurance typically does not cover your death or bodily injury resulting from a car accident.

- Comprehensive car insurance only covers damages to your vehicle and the other party’s vehicle. Consider adding Personal Accident insurance or a separate medical/personal accident insurance policy for coverage.

- Passenger Claims Liability

- Your liability for passenger claims may not be covered by standard car insurance.

- Add a Passenger Liability Extension Cover to your car insurance policy to address this.

- Custom Car Accessories

- Standard car insurance policies may not cover the costs of repairs or replacements for custom car accessories.

- Check with your car insurance provider to see if you can extend coverage to these accessories.

- Consequential Loss, Depreciation, Wear and Tear

- Car insurance usually does not cover consequential loss, depreciation, wear and tear, mechanical or technical breakdowns, or breakages.

- For older vehicles, especially those approaching 15 years of age, consider opting for a third-party cover instead of comprehensive insurance.

- Acts of Nature (e.g., Floods, Landslides, Typhoons)

- Standard car insurance policies often exclude coverage for vehicle damage caused by natural disasters or acts of God.

- You can enhance your policy with additional coverage against natural disasters, albeit at a higher premium.

5. What Additional Covers Are Available for Car Insurance?

The car insurance policy allows policyholders to expand their coverage by incorporating additional benefits and protection beyond the standard coverage. Contact your insurers to request these supplementary covers to find the types of additional covers offered.

- Coverage for natural events such as floods, windstorms, rainstorms, typhoons, hurricanes, volcanic eruptions, earthquakes, landslides/landslips, subsidence or sinking of the soil/earth, and other convulsions of nature.

- Protection against the breakage of glass in the windscreen or windows.

- Coverage for strikes, riots, and civil commotion.

- Inclusion for tuition and testing purposes.

- Option to add an additional named driver.

- Extension of coverage to all drivers for private car policies issued to companies or businesses exclusively.

- Passenger liability coverage.

- Coverage for the liability of passengers for acts of negligence.

- Inclusion of additional business use.

6. What Factors Are Considered in Calculating Car Insurance Premium Rates?

Before July 2017, car insurance rates in Malaysia were the same for all providers, set by Bank Negara Malaysia (BNM) based on vehicle value and engine capacity. Premiums were calculated using technical details, age, and the car’s market value.

Since the de-tariffication in July 2017, insurance companies have used more factors to set premiums. This risk-based approach encourages drivers to reduce risks for lower premiums. Key factors include:

| Factor | Impact on Premiums |

|---|---|

| Age | ‘P’ license holders may face higher premiums due to perceived higher risk from lack of driving experience. |

| Gender | Gender is considered a risk factor; common belief suggests male drivers may exhibit more aggressive behaviour. |

| Occupation | Jobs involving frequent road travel may lead to higher premiums (e.g., bus drivers compared to office workers). |

| Residence | Premiums may vary based on location, with higher rates in areas with higher crime rates and increased vehicle risk. |

| Claim History | Numerous past claims lead to increased premiums, indicating a higher perceived risk. |

| Use of Car | The more miles driven annually, the higher the perceived risk, influencing the premium amount. |

7. What Makes Car Insurance Different From Personal Accident Insurance?

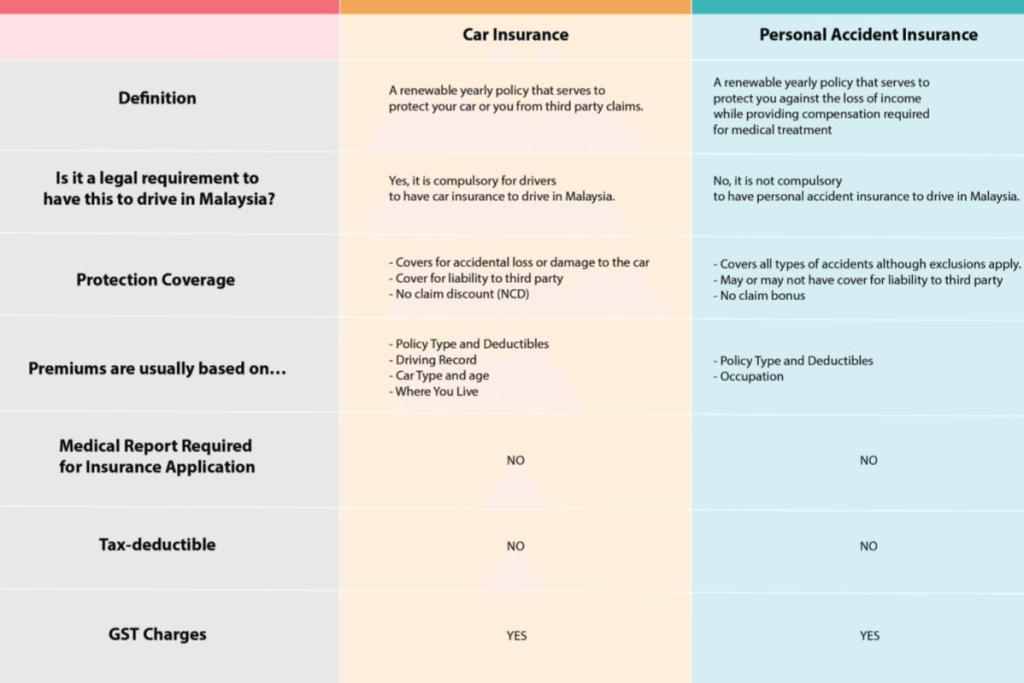

Car and personal accident insurance serve different purposes and cover distinct aspects of risk. Here is a simple yet comprehensive table taken from RinggitPlus to identify what makes them different:

In summary, car insurance and personal accident insurance serve different purposes—one protects the vehicle and associated risks, while the other provides coverage for the individual’s well-being in case of accidents, irrespective of the context. It is common for individuals to have both types of insurance to ensure comprehensive coverage.

Grab Your Complimentary Lazada Voucher 【Here】

Tons of Shopee Cashback Deals 【Here】

Disclosure: This list was compiled by the team at My Weekend Plan after extensive research and shared opinions to suggest helpful recommendations for the public. The sequence of brands is in no particular order so if you have any other great suggestions too, please email us support@myweekendplan.asia. For more information, kindly refer to our copyright, privacy & disclosure policy.