Bank of America analysts predict that gold prices could soar to $3,000 per ounce within 12-18 months. However, they caution that current market conditions don’t fully support this forecast.

According to BofA, hitting the $3,000 mark depends on a rise in non-commercial demand. They suggest that a rate cut by the Federal Reserve could spark this demand, resulting in more investments in physically backed gold ETFs and increased trading volumes.

Gold prices have surged nearly 13% this year, closing at $2,331.86 (around RM10,980) on Monday. During today’s Asian market session, prices fluctuated slightly, settling at $2,329.46 per ounce (about RM10,968) at 9:20 AM Malaysian time, a 0.21% drop.

Recent reports from Bank of America and Citi suggest that gold prices could reach $3,000 next year, marking a 30% increase from current levels. Global central banks are expected to buy more gold to reduce reliance on the US dollar in their foreign exchange reserves.

Concerns about US bonds fuel the gold bull market. According to Bank of America, sharp fluctuations in the US Treasury market are considered a “tail risk” likely to grow over time. They emphasise that the bond market doesn’t need a major disaster to drive demand; even increasing worries about potential issues can be enough.

Citi analysts also point out that strong physical demand, central bank purchases, and macroeconomic factors could push gold prices to $3,000 in the next 12 months. They believe gold will remain supported above $2,000 to $2,200 per ounce (around RM9,417 to RM13,580) and may test historical highs by the end of 2024, soaring to $3,000 in 2025.

Is it The Best Time to Buy Gold in Malaysia?

In Malaysia, like elsewhere, gold prices hinge on global trends. It’s a safe-haven asset that rises during economic uncertainty and falls during stability. Recently stable amid a healthy global economy, shifts in sentiment can swiftly alter this landscape, especially during crises or major events.

Individuals with greater capital might find it advantageous to buy gold now, expecting its price to increase. Analysts foresee a continued rise in gold prices amid ongoing inflationary pressures. This could present a timely opportunity for selling gold, potentially yielding substantial returns. Additionally, some buyers are motivated by personal satisfaction and are often drawn to gold products’ latest and most attractive design updates.

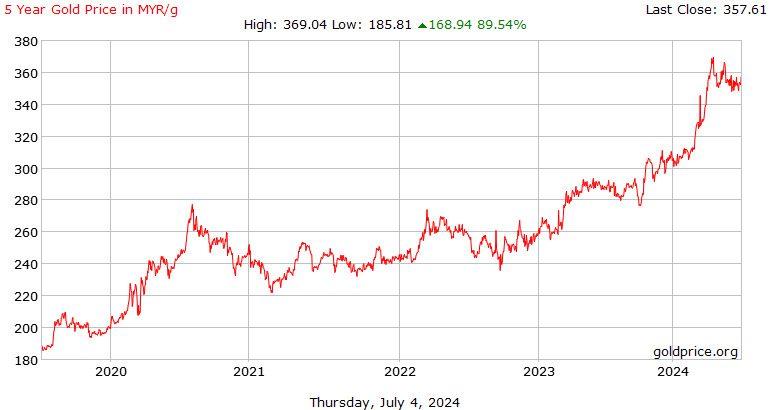

Below is a screenshot of the gold price history in Malaysia per gram from 2020 to 2024.

Over the last five years, the price of gold per gram in MYR has nearly doubled. It began around MYR 184.34 in mid-2019 and peaked at MYR 369.04 by 2024, marking an 88.18% increase. Though there were fluctuations, notably in 2020 and 2023, the overall trend has been upward. As of June 28, 2024, the price is MYR 353.15 per gram, underscoring robust demand and investment appeal in gold.

Which Is More Valuable: Gold Bars or Jewellery?

Due to their high value, gold bars are primarily used for savings and investment. For the best long-term investment, 24K or 999 gold is the purest form, containing 99.9% gold with no other metal admixtures, making it the top choice for investors.

Regarding gold jewellery, there are various karat options like 22K, 18K, and 9K, each with different purity levels. 22K gold is especially popular for its excellent balance of purity and durability, making it ideal for everyday wear. Women can invest in gold jewellery, combining style with value, making it a suitable investment option.

However, gold jewellery involves higher craftsmanship costs compared to gold bullion. While gold bars have minimal labour costs due to their simple shape, jewellery pieces require more intricate work, leading to higher costs.

Purity is a key factor when investing in gold. That’s why gold bars and coins are preferred, as they have the highest purity, typically 999.9 or 24K. If you’re more interested in jewellery, now is the perfect time to invest in gold as prices rise.

Find out the Best Jewellery Shops in Malaysia. You can consider gifting this exquisite jewellery to someone special—your mother, daughter, or mother-in-law. So, which do you want, investment, gold or jewellery? Whatever your choice, both provide benefits and returns because gold is the best store of value in the long term.

Source: Investor, The Edge Malaysia, economies.com, Habib Jewels, Citi Group

What is your opinion? Read, share, and like, okay!

Attention: The admin will not be directly responsible for the comments made by our readers. Therefore, all comments are the right and responsibility of the readers themselves.