In Malaysia, having a clear understanding of credit scores is paramount for anyone navigating the financial landscape. Credit scores play a pivotal role in determining an individual’s creditworthiness, influencing their ability to secure loans, credit cards, or other financial products. This guide delves into the intricacies of two crucial credit reporting systems in Malaysia – CCRIS (Central Credit Reference Information System) and CTOS (Credit Bureau of Malaysia).

By unravelling the complexities of these credit scores, individuals can empower themselves with the knowledge needed to make informed financial decisions and build a positive credit history. As we explore these credit scoring systems, this guide aims to demystify the factors influencing credit scores, highlight the significance of a favourable credit profile, and provide practical insights to help individuals manage and improve their creditworthiness in the Malaysian financial landscape.

1. What is CCRIS?

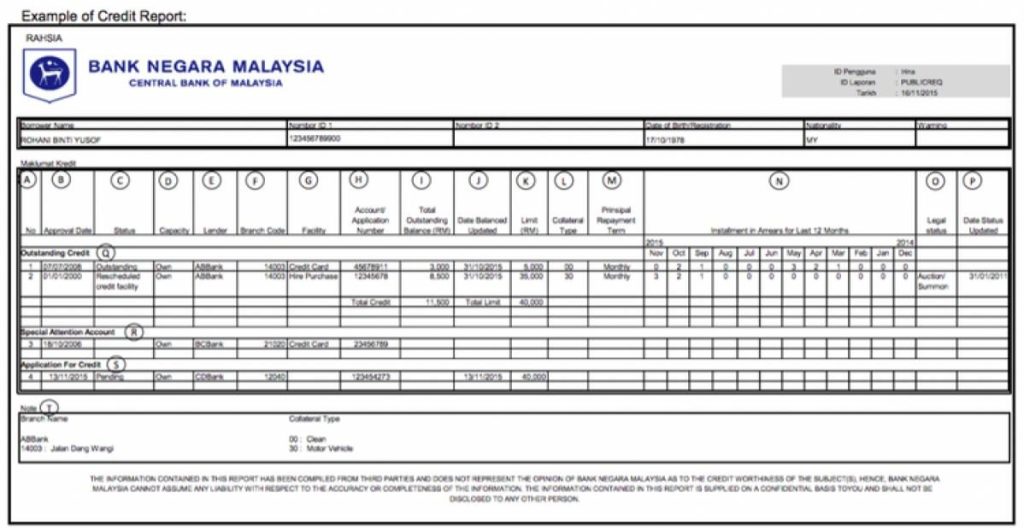

CCRIS, or Central Credit Reference Information, is managed by the Credit Bureau of Bank Negara Malaysia and is a crucial tool for banks and financial institutions in assessing an individual’s creditworthiness.

Unlike CTOS, CCRIS does not assign a specific credit score but provides a detailed credit report, including information on credit accounts, repayment history, credit applications, and outstanding debts.

Understanding your CCRIS report is essential because it significantly influences your financial opportunities. Whether you are applying for a credit card, seeking a home loan, job hunting, or applying for a personal loan, your creditworthiness plays a pivotal role in determining approval.

Creditworthiness reflects your ability to repay debts promptly and in full. It considers factors like credit history, income, employment status, and financial commitments. A person deemed creditworthy is more likely to receive approval for loans and credit cards, often with more favourable terms and lower interest rates.

2. How Do You Check a CCRIS Report?

Every bank or financial institution operating in Malaysia must submit their customers’ credit information to this centralised system. Access to a CCRIS report is restricted to the individual concerned, allowed no more than once every three months, or to a financial institution upon request.

Here are ways to obtain a CCRIS report:

- Online: Access your report on the eCCRIS website. While the service is free, initial registration must be done in person at any BNM Malaysia branch.

- In-person: Obtain a copy of your CCRIS report at the BNM Head Office and BNM Regional Offices or via a kiosk at selected BNM branches.

- By correspondence: Send your request for a report to BNM TELELINK through mail, email, or fax at Bank Negara Malaysia.

3. How to Improve Your CCRIS Report?

There are a few ways you can improve your CCRIS report, including:

- Ensure Timely Loan Repayments

Discipline yourself to make timely loan repayments. Aim to settle outstanding payments consistently for 12 months before applying for a new loan to impact your CCRIS report positively. - Strategically Time Loan Applications

The CCRIS system updates on the 15th of each month, considering payments made until the end of the previous month. Apply for a loan after the 16th of a month in which all outstanding payments have been settled before the previous month’s end. - Avoid Late Monthly Payments

If your recurring payment date often precedes your payday, leading to late payments, consider requesting your bank to adjust the payment date to align with your payday or set aside funds for timely payments. - Establish Standing Instruction

Set up standing instructions with your bank to automatically make payments on a selected date each month if you tend to overlook due dates. - Maintain a Credit History

Contrary to the belief that having no loans or credit cards improves your CCRIS, maintaining a positive credit history is crucial. A solid credit history aids banks in assessing your repayment capability for loans and credit cards.

4. What is CTOS?

While the name CTOS might evoke thoughts of a sci-fi robot, it is a private credit reporting agency authorized by Bank Negara Malaysia. Like CCRIS, CTOS monitors your credit history and assigns a numerical representation known as the CTOS score, akin to a credit health report card or a GPA for your credit.

This score ranges from 300 to 850, with a higher score indicating a lower credit risk, making loan approval more accessible. CTOS compiles data from various sources, including banks, financial institutions, and legal entities, to generate a comprehensive credit report.

This report includes personal details, credit accounts, repayment history, outstanding debts, bankruptcy status, legal actions and case statuses, and details about business ownership.

5. How Do You Check a CTOS Score?

Individuals or companies in Malaysia can access their free basic CTOS report online by registering on the CTOS website or mobile application. For a more comprehensive MyCTOS Score Report, there is a fee of RM26.50.

Visit the CTOS website and choose from the available packages, including MyCTOS Basic Report, MyCTOS Score Report, and CTOS SecureID.

Verified users are eligible for two complimentary MyCTOS Basic Reports annually, distributed in January and July.

6. What Are the Differences Between CCRIS and CTOS?

If you find it challenging to distinguish between CCRIS and CTOS, here is a straightforward explanation:

| Aspect | CCRIS | CTOS |

|---|---|---|

| Created by | Bank Negara Malaysia’s (BNM) Credit Bureau | CTOS Data Systems Sdn Bhd, a private credit reporting agency |

| Data Sources | Gathers credit-related information from financial institutions like banks | Collects credit-related information from diverse sources, including legal firms, government agencies, and telecommunications companies |

| Compilation Approach | Offers factual data utilised by financial institutions | Generates a creditworthiness score that succinctly represents your credit standing |

7. What Is It Important to a Healthy Credit Score?

According to CTOS, maintaining a healthy credit score is crucial for several reasons:

- Higher Approval

If you maintain a good credit score, banks and lenders are more likely to approve your credit card or loan applications. A poor credit score signals a history of missed payments, making lenders hesitant to do business with you. - Quicker Approval Process

Your credit score influences how fast your credit application gets approved. Higher scores lead to quicker decisions by banks and lenders, while lower scores may result in a longer wait as applications go through additional scrutiny. - Savings on Interest

A healthier credit score means lower interest rates on credit cards or loans. This helps you save money in the long run, as higher interest rates translate to paying more to the bank or lender. - Enhanced Negotiation Power

With a high credit score, you have the confidence to negotiate better terms when applying for new loans or credit cards. Lenders see your consistent payment history, making you a more reliable borrower. - Possibility of Higher Credit Limits

A healthy credit score and your income influence the amount you can borrow. Lenders are more likely to trust you with a higher credit limit when your credit score reflects responsible bill repayment.

Grab Your Complimentary Lazada Voucher 【Here】

Tons of Shopee Cashback Deals 【Here】

Disclosure: This list was compiled by the team at My Weekend Plan after extensive research and shared opinions to suggest helpful recommendations for the public. The sequence of brands is in no particular order so if you have any other great suggestions too, please email us support@myweekendplan.asia. For more information, kindly refer to our copyright, privacy & disclosure policy.